Is your prized tonneau cover protected by insurance? If an unexpected event damages or steals your tonneau cover, you might be wondering whether insurance coverage can come to the rescue.

Understanding the ins and outs of insurance coverage for tonneau covers is crucial for every truck owner.

In this article, we’ll explore the intriguing world of tonneau cover insurance, shedding light on what’s covered, what factors come into play, and how to navigate the claims process.

Let’s unravel the mysteries of insurance coverage for tonneau covers!

Does insurance cover tonneau cover?

Yes, insurance can cover tonneau covers. It depends on the insurance policy you have. Check your policy details or contact your insurance provider to determine if your tonneau cover is covered and what type of coverage is offered.

Types of Insurance Coverage for Tonneau Covers

The specific types of insurance coverage for tonneau covers can vary depending on your insurance provider and policy.

It’s essential to review your policy documents or consult with your insurance agent to understand the extent of coverage provided for your tonneau cover.

1. Comprehensive Insurance Coverage

Comprehensive insurance provides coverage for damage or loss to your tonneau cover resulting from events other than collisions, such as theft, vandalism, fire, or severe weather conditions.

With comprehensive coverage, you can have peace of mind knowing that your tonneau cover is protected against a wide range of risks.

2. Collision Insurance Coverage

Collision coverage is designed to cover the cost of repairing or replacing your tonneau cover if it gets damaged in a collision with another vehicle or object.

Whether it’s a fender bender or a more significant accident, collision insurance can help cover the repair or replacement expenses for your tonneau cover.

3. Specified Perils Insurance Coverage

Specified perils coverage offers protection for specific risks that are explicitly listed in your insurance policy.

This coverage can include perils like theft, fire, lightning, explosion, earthquake, windstorm, hail, or damage caused by falling objects.

It’s important to review your policy to determine the specific perils covered for your tonneau cover.

4. Comprehensive Auto Insurance Policy

Some comprehensive auto insurance policies automatically include coverage for tonneau covers as part of their standard package.

This means that you don’t have to purchase additional coverage specifically for your tonneau cover, as it is already included in your policy.

Check with your insurance provider to see if your policy offers this coverage.

5. Customized Coverage Options

Insurance companies may offer additional customized coverage options for tonneau covers.

These options could include coverage for aftermarket tonneau covers, coverage for accessories attached to the tonneau cover, or coverage for damages caused by the improper installation of the cover.

Speak with your insurance provider to explore any tailored coverage options available.

Factors That Determine Insurance Coverage for Tonneau Covers

Various factors that determine insurance coverage for tonneau covers can vary among insurance providers and policies

1. Vehicle Insurance Policy

Your vehicle insurance policy is a primary factor that determines whether your tonneau cover is covered.

Different policies have varying terms and conditions regarding coverage for tonneau covers.

Review your policy documents or contact your insurance provider to understand the specific coverage provided for your tonneau cover.

2. Comprehensive Coverage Selection

The type of coverage you select for your vehicle plays a crucial role in determining if your tonneau cover is covered.

Comprehensive coverage typically offers protection against non-collision incidents, such as theft, vandalism, or weather damage.

Ensure that your insurance policy includes comprehensive coverage to have a higher likelihood of covering your tonneau cover.

3. Policy Deductible

The deductible on your insurance policy is the amount you are responsible for paying out of pocket before insurance coverage kicks in.

The deductible can impact the coverage for your tonneau cover. Consider the deductible amount and its impact on the potential reimbursement for tonneau cover damages or losses.

4. Tonneau Cover Type

Different types of tonneau covers may have varying levels of coverage under insurance policies.

Factors such as the material, design, and security features of the tonneau cover can influence its insurability.

Verify with your insurance provider if the specific type of tonneau cover you have is eligible for coverage.

5. Installation and Security Measures

The installation method and security measures you have in place for your tonneau cover can also affect insurance coverage.

Insurance providers may consider factors such as lock systems, additional security devices, or professional installation when determining coverage options.

Ensure that you follow recommended installation guidelines and take appropriate security measures to maximize coverage eligibility.

6. Policy Endorsements or Add-Ons

Some insurance policies offer optional endorsements or add-ons that provide specific coverage for tonneau covers.

These endorsements may enhance the coverage limits or extend the scope of coverage for your tonneau cover.

Review your policy details to check if any additional endorsements or add-ons are available for your tonneau cover.

7. Insured Vehicle Usage

The intended usage of your insured vehicle can impact coverage for the tonneau cover.

Insurance policies may have restrictions or limitations based on factors such as personal use, commercial use, or specific vehicle modifications.

Understand the usage terms outlined in your policy to determine how they relate to the coverage of your tonneau cover.

How to File an Insurance Claim for a Damaged Tonneau Cover?

Here’s how you can file an insurance claim for a damaged tonneau cover:

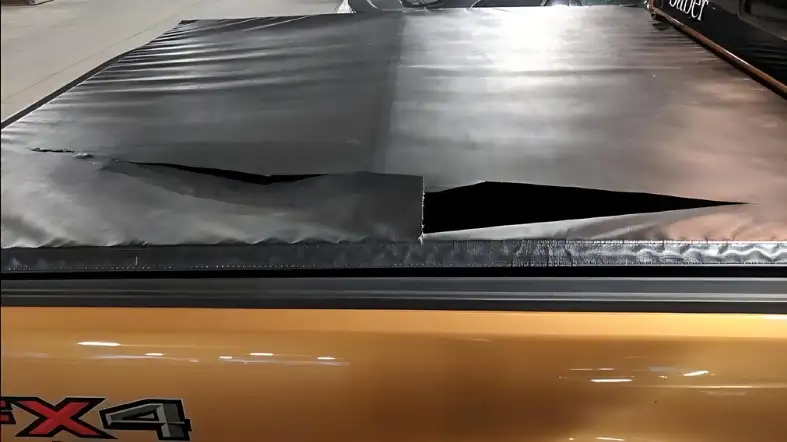

1. Document the Damage

Start by thoroughly documenting the damage to your tonneau cover. Take clear and detailed photographs from multiple angles, ensuring that all the damages are visible.

Note down any relevant information, such as the date, time, and circumstances of the incident that caused the damage.

2. Review Your Insurance Policy

Refer to your insurance policy documents to understand the specific coverage provided for tonneau cover damage.

Familiarize yourself with the terms, conditions, and any deductibles that may apply to the claim. This will help you navigate the claims process more effectively.

3. Contact Your Insurance Provider

Reach out to your insurance provider as soon as possible to report the damage and initiate the claims process.

Provide them with the necessary details, such as your policy number, the incident date, and a description of the damage.

Follow their instructions on how to proceed with the claim.

4. Provide Supporting Documentation

Submit the documented evidence of the damage, including the photographs and any relevant information you gathered.

Be prepared to answer any additional questions or provide any other supporting documents that your insurance provider may request.

5. Obtain Repair Estimates

Depending on your insurance provider’s requirements, you may need to obtain repair estimates for the damaged tonneau cover.

Contact reputable repair shops or dealerships specializing in tonneau covers and request detailed written estimates for the necessary repairs or replacement.

6. Complete the Claim Form

Fill out the insurance claim form provided by your insurance provider.

Provide accurate and complete information, including your contact details, policy information, and a detailed description of the incident and damage.

Ensure that you include the repair estimates and any other requested documentation.

7. Submit the Claim

Submit the completed claim form and all supporting documents to your insurance provider through the designated channels.

Follow their instructions regarding the preferred method of submission, whether it’s online, via email, or through traditional mail.

8. Cooperate with the Insurance Adjuster

An insurance adjuster may be assigned to assess the damage and validate the claim.

Cooperate fully with the adjuster, providing them access to the tonneau cover and any other relevant information they may require.

Answer their questions and provide any additional documentation promptly.

9. Await Claim Resolution

Once all the necessary documentation and assessments are completed, await the resolution of your claim.

Your insurance provider will review the details, assess the coverage, and determine the appropriate reimbursement or repair options for your damaged tonneau cover.

10. Follow-Up and Communication

Stay in regular communication with your insurance provider regarding the status of your claim.

Ask for updates and clarification whenever needed. If there are any delays or issues, inquire about the reasons and seek resolutions proactively.

How to Choose the Right Insurance Policy for Your Tonneau Cover?

Selecting the right insurance policy for your tonneau cover is a crucial step in protecting your investment.

Take the time to research, compare, and evaluate the options available to make a well-informed decision that meets your specific coverage needs and budget requirements.

1. Assess Your Coverage Needs

Begin by assessing your specific coverage needs for your tonneau cover.

Consider factors such as the value of the cover, its susceptibility to damage or theft, and your budget for insurance premiums.

Determine the level of coverage you require based on these factors.

2. Research Insurance Providers

Conduct thorough research to identify reputable insurance providers that offer coverage for tonneau covers.

Look for providers with a strong track record, positive customer reviews, and competitive rates.

Explore their coverage options and policies to find the best fit for your needs.

3. Understand Policy Terms and Coverage

Carefully review the terms and conditions of insurance policies that include coverage for tonneau covers.

Pay attention to the specific coverage limits, deductibles, and any exclusions or limitations that may apply.

Ensure that the policy aligns with your coverage requirements.

4. Compare Premiums and Deductibles

Compare the premiums and deductibles of different insurance policies to find the most cost-effective option.

Consider the trade-off between lower premiums and higher deductibles, and choose a balance that suits your budget and risk tolerance.

5. Evaluate Additional Coverages

Some insurance policies may offer additional coverages or endorsements specifically for tonneau covers.

These may include coverage for aftermarket or custom tonneau covers, accessories attached to the cover, or damages caused by improper installation.

Assess whether these additional coverages align with your needs.

6. Review Claim Process and Customer Support

Examine the claim process and customer support offered by insurance providers.

Ensure that the claims process is straightforward and efficient and that the provider has a reliable customer support system in place.

Prompt and helpful support can make a significant difference when filing a claim.

7. Seek Recommendations and Expert Advice

Reach out to fellow truck owners, friends, or industry experts who have experience with insuring tonneau covers.

Ask for recommendations and gather insights about their experiences with different insurance providers.

Their firsthand knowledge can help you make an informed decision.

8. Request Quotes and Compare

Request quotes from shortlisted insurance providers based on your coverage needs.

Compare the quotes side by side, taking into account the coverage, deductibles, and premiums. Consider the value offered by each policy to make an informed choice.

9. Seek Clarification

If you have any questions or concerns about a particular insurance policy, don’t hesitate to reach out to the provider for clarification.

It’s essential to have a clear understanding of the policy’s terms and coverage before making a final decision.

10. Make an Informed Decision

After evaluating all the factors, making comparisons, and seeking advice, make an informed decision regarding the right insurance policy for your tonneau cover.

Choose the policy that provides the necessary coverage, aligns with your budget, and offers the peace of mind you seek.

Benefits of Insuring Your Tonneau Cover

There are various benefits of insuring your tonenau covers:

1. Financial Protection

By insuring your tonneau cover, you gain financial protection against potential damages or losses.

In the event of theft, vandalism, or accidental damage, your insurance coverage can help cover the cost of repairing or replacing your tonneau cover, saving you from incurring significant out-of-pocket expenses.

2. Peace of Mind

Knowing that your tonneau cover is protected by insurance brings peace of mind.

Whether you park your vehicle in public spaces or in areas prone to theft or damage, having insurance coverage ensures that you’re prepared for unforeseen circumstances.

You can drive with confidence, knowing that your tonneau cover is safeguarded.

3. Comprehensive Coverage

Insurance policies often provide comprehensive coverage for tonneau covers.

This means that damages caused by various incidents, such as theft, vandalism, fire, or severe weather conditions, can be covered.

Comprehensive coverage offers a broad range of protection, allowing you to feel secure in various scenarios.

4. Easy Claims Process

In the unfortunate event that your tonneau cover gets damaged or stolen, having insurance makes the claims process easier.

You can reach out to your insurance provider, report the incident, and initiate the claims process.

With the right documentation and support, you can navigate through the process smoothly and efficiently.

5. Cost-Effective Solutions

Compared to paying out-of-pocket for repairs or replacements, insurance coverage for your tonneau cover can be a cost-effective solution.

Instead of bearing the full financial burden, you only need to cover deductibles or a portion of the costs specified in your policy. This can save you money in the long run.

6. Customizable Coverage

Insurance policies for tonneau covers often offer customizable coverage options.

Depending on your needs and preferences, you may have the flexibility to tailor your coverage to specific requirements.

This ensures that you receive the right level of protection for your tonneau cover and any additional accessories or modifications.

7. Protection Against Unforeseen Events

Insurance coverage provides protection against unpredictable events.

Whether it’s damage caused by severe weather, an accident, or theft, your tonneau cover is shielded from the financial consequences of these incidents.

Insuring your tonneau cover offers a safety net, allowing you to focus on enjoying your truck.

8. Preserving the Value of Your Investment

Tonneau covers can be a significant investment for truck owners. By ensuring your tonneau cover, you help preserve its value.

In the event of damage or theft, insurance coverage allows you to repair or replace the cover without depleting your savings or affecting the overall value of your vehicle.

9. Coverage Extension

In addition to protecting the tonneau cover itself, insurance coverage may also extend to other components or accessories attached to the cover.

This means that damages to additional items, such as cargo management systems or bed liners, can be included in your coverage, providing comprehensive protection for your truck.

Can the Cost of Painting a Tonneau Cover be Covered by Insurance?

The cost of painting a tonneau cover may or may not be covered by insurance, depending on the specific coverage policy. It is advisable to consult with your insurance provider to determine if they offer coverage for this particular expense.

FAQs

Do I Need A Specific Insurance Policy To Cover My Tonneau Cover?

No, coverage for tonneau covers can typically be included in your comprehensive auto insurance policy.

Review your policy details to confirm the coverage.

Will Insurance Cover The Full Cost Of Replacing My Tonneau Cover?

The coverage provided by insurance varies. Some policies may cover the full cost, while others may have deductibles or limits on reimbursement.

Check your policy details to understand the coverage specifics.

Is It Necessary To File A Police Report For Tonneau Cover Theft To Be Eligible For Insurance Coverage?

In many cases, filing a police report is required to support your insurance claim for tonneau cover theft. Contact your insurance provider for specific instructions.

Can I Choose Any Repair Shop For Tonneau Cover Repairs Covered By Insurance?

Insurance policies may have preferred repair shops or require you to obtain estimates from authorized providers.

Check your policy or consult with your insurance provider for guidance.

Are Aftermarket Tonneau Covers Eligible For Insurance Coverage?

Yes, insurance coverage for tonneau covers often extends to aftermarket options.

Ensure that your policy covers aftermarket tonneau covers and any modifications or accessories attached to them.

final words

Protecting your tonneau cover with insurance offers peace of mind and financial security.

By understanding your insurance policy and coverage options, you can ensure that your tonneau cover is protected against theft, damage, and other unforeseen events.

With the right coverage in place, you can enjoy the benefits of your tonneau cover, knowing that you have the necessary protection.

Safeguard your investment and take advantage of the convenience and style that a tonneau cover provides, backed by the confidence of insurance coverage.